How Torpago Helps Banks Control Their Commercial Card Programs

After hundreds of conversations with bank leaders, we have come across the same burning question: does Torpago provide actionable insights to my card program?

Yes. Improving data accessibility was one of the core motivations for launching ‘Powered By’ Torpago. This post covers how Torpago's Bank Admin Tool (‘BAT’) provides real-time data access and no-code controls that help banks make effective business decisions.

What is Powered By Torpago?

Powered By Torpago is a white-label commercial card and expense management software program for financial institutions. Banks use Powered By to deploy a market-leading product to their business banking clients with the goals of generating new income streams, growing deposits and improving operating efficiency.

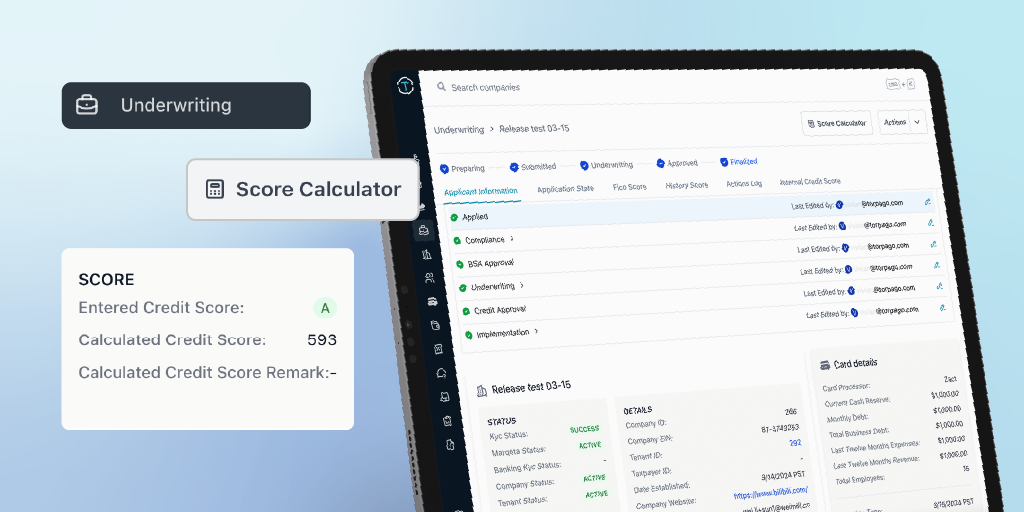

What is Torpago’s Bank Admin Tool?

Banks use the BAT as a centralized operating system for their Powered By program.

With permissioned access tiers, the BAT empowers bank employees to view or control loan origination, transaction monitoring, account servicing, and more. In turn, the BAT drives growth and operational excellence.

What can real-time data and controls do for my commercial card program?

Built from the ground up on the cloud, the BAT allows banks to both see and react to data in real-time. From a growth perspective, this helps banks know when to initiate a targeted promotion, modify credit limits, or pursue specific customer types. Furthermore, Powered By program data may help banks identify areas for improvement within their broader client relationships. From an operational perspective, the BAT ensures that all stakeholders track the same information and process. This becomes particularly important when resolving KYC failures, fraud incidents or general servicing events. Bank employees leveraging the BAT can resolve such incidents in a shorter period, improving both customer and bank employee experience.

Some of the real-time data available in Torpago’s BAT includes:

- Application Status

- Underwriting

- Compliance

- Businesses

- Cardholders

- Cards

- Transactions

- Disputes

- Card Utilization

- Fraud Monitoring

- Statements

- Repayment History

Curious to know more about what it's like working with Torpago or ready to start a conversation about launching a modern commercial credit card program? You can reach out to schedule a time with Torpago’s team by emailing sales@torpago.com or filling out the form on our Contact Us page.

Still need more information about partnering with Torpago? You can download our technical brief where we discuss our partnership with Sunwest Bank!