Tight Credit Has Sent Small Business Shopping for Loans. How Community Banks Can Capitalize.

One consequence of the current higher-rate environment is that it’s become more challenging for small businesses to secure credit, particularly from larger banks. According to one report, approval rates for small business loans at big banks dropped to just 13.2% in July. By comparison, approval rates at community banks were 19.1% in the same month. This means that small business owners that bank with big banks have to shop around for credit, creating an opportunity for community banks to win their business.

Get Your Name Out There

Whether you’re going with a physical-focused or a digital-first strategy, prospective customers need to know that your bank exists. If you’ve been under-investing in your marketing, now is the time to stop staying quiet and start getting your name out there.

When marketing to small businesses, it’s important to remember that perceptions and definitions of a “small business” vary greatly. Based on the Small Business Administration’s size standards, companies with over 1,000 employees or gross receipts in the tens of millions per year. Companies of that size may not consider themselves small businesses and will be responsive to different language than a coffee shop owner – and will have different financial needs.

Highlight That Small Business Matters

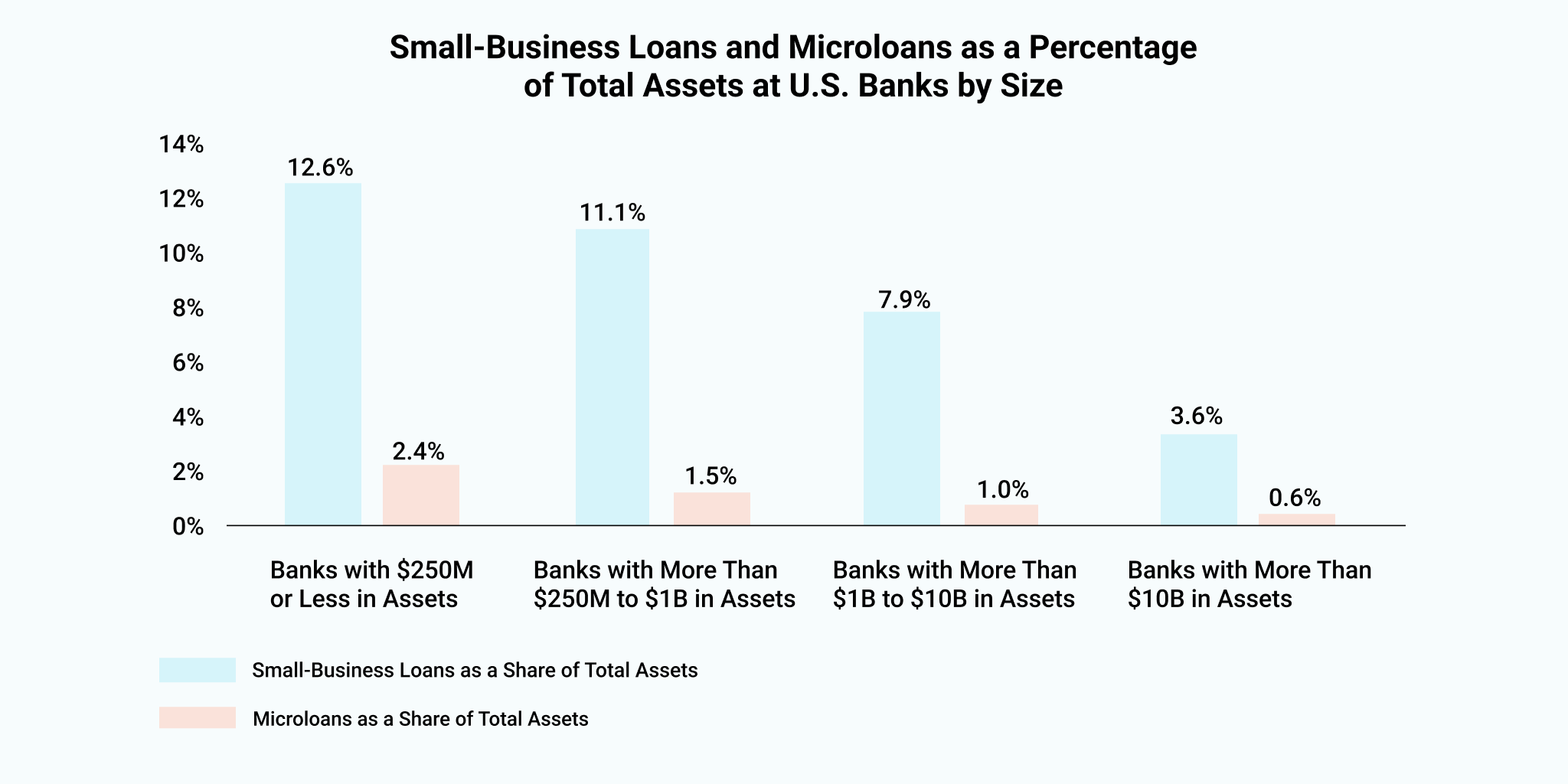

Big banks are often accused of not caring about small businesses or small borrowers. While litigating that question is best left to the chattering types on X/Twitter, what is true is that small business loans make up a much smaller percentage of big bank assets compared to their share at smaller banks.

According to a report by the St. Louis Fed, small business loans and microloans (business loans under $100,000) account for at least 9% of the assets at banks with under $10 billion in assets – jumping all the way to 15% for the smallest banks. By comparison, these loans account for just 4.2% of the assets at banks with over $10 billion in assets.

This provides community banks with the opportunity to show that they really do care about small business clients and that they understand their needs. People who have already been turned down by bigger banks will be even more receptive to this messaging when they are shopping for a potential lender, especially if there’s a promised benefit such as a streamlined application process or reduced paperwork needs.

Unlike big banks, community banks can create underwriting processes tailored to the needs of their industry or community. An easy application process that leads to a quick decision is an opportunity to surprise and delight a first-time customer who is likely already stressed out from the challenge of trying to secure a loan and may need the funds urgently.

SOURCE: Reports of Condition and Income for U.S. commercial banks, June 2023.

Create the Right Loan Products

Small business financing needs are as diverse as small businesses themselves. Customized solutions are a significant selling point for community banks. Offering a range of loan products tailored to various business needs, such as working capital, expansion, or equipment financing, will make your bank more prepared to answer a prospective customer’s question.

Since small businesses often don’t have dedicated financial teams, it’s important to be clear about the purposes and advantages of each loan type and avoid financial jargon whenever possible – especially if a business owner is applying for business credit for the first time. A person who feels like they were truly helped instead of just sold to will be more likely to want to expand the relationship over time by moving their bank accounts or taking out additional loans.

Digital Experience

One well-established reason why big banks are preferred over small ones is easy access to branches. However, with the digitization of finance, branch access is less important than it used to be, especially for B2B companies that may never transact in cash.

As a result, a well-designed and high-functioning digital experience is critical for winning over business customers. This includes user-friendly online platforms for loan applications, account management, and digital communication channels to enhance accessibility and convenience.

When it comes to small business loans, the digital experience should include the ability to complete an application without going into a branch. Uploading any documentation needed should be doable entirely through the application as well – applicants should never be asked to email documents containing PII.

Will the Credit Crunch Last?

It’s uncertain how long tight lending conditions will last, but interest rates are expected to remain elevated at least through 2025. This means community banks have a year or two to capitalize on the disruption of big bank lending for small businesses – those that don’t already have small business lending initiatives should look to get them up and running by the end of Q1 of 2024. And if your community bank’s digital transformation efforts haven’t been moving quickly, now is the time to speed them up.