[New eBook] The Business Reimbursement Model Is Dying: Making the Transition from Expensive Reimbursement

For many years, small and medium companies have asked their employees to “float" the expenses of the business by using personal credit cards to charge costs. It amounted to employees providing their companies with no-interest loans and a significant amount of work to process it all.

Today's employees aren't happy about the old-school expense reimbursement model, especially Millennial and Gen Z workers who may not have the financial resources to wait for reimbursements to process.

Expense reimbursement models have been around for a long time, but they have fallen into the “we've always done it that way" category rather than a “that's how we should do it" model. In this eBook, we'll examine how the traditional business expense reimbursement model came to be, why you need to make a change, how to transition to a more modern solution, and how Torpago provides a better way to do business.

How Old School Expense Reimbursement Came to Exist

Many things in business made sense at one time, but the underlying reason no longer exists, or newer technology made it obsolete. Fax machines were once a staple in every office, but email and connected devices silenced them. Computers replaced typewriters. Video conferencing cut down on business travel and face-to-face meetings. Business process automation (BPA) is replacing manual data entry.

Old school reimbursement methods are a relic of a bygone era, and the reasons these processes came into existence are rarely relevant today. Decades ago, many companies didn’t have enough cash to cover large purchases and needed time to pay. By reimbursing employees for expenses they incurred on the company's behalf, businesses avoided having to pay upfront. Other businesses could not qualify for enough credit, so they needed help from employee credit cards.

In other cases, businesses simply didn't trust their employees with business credit cards or limited the use of business cards to top executives only. Many individuals came to like this model because of the prevalence of reward cards. For some employees, putting business expenses on their personal credit card became almost a revenue stream, qualifying for cash-back rewards or travel perks.

Over time, this methodology became the norm in businesses.

However, tracking spending, filling out and submitting expense reports, attaching receipts, and processing reimbursement all create a fair amount of work for employees and accounting teams that is no longer necessary. Thanks to modern spend management platforms, lost receipts, tracking down spending details, and the waiting period for reimbursement have all become obsolete.

Why You Should Move to a Better Solution

While some people like the perks of using their personal credit cards, most employees hate the expense reimbursement process — especially younger workers and those outside the executive ranks.

A Faster, Simpler, More Secure Way to Do Business

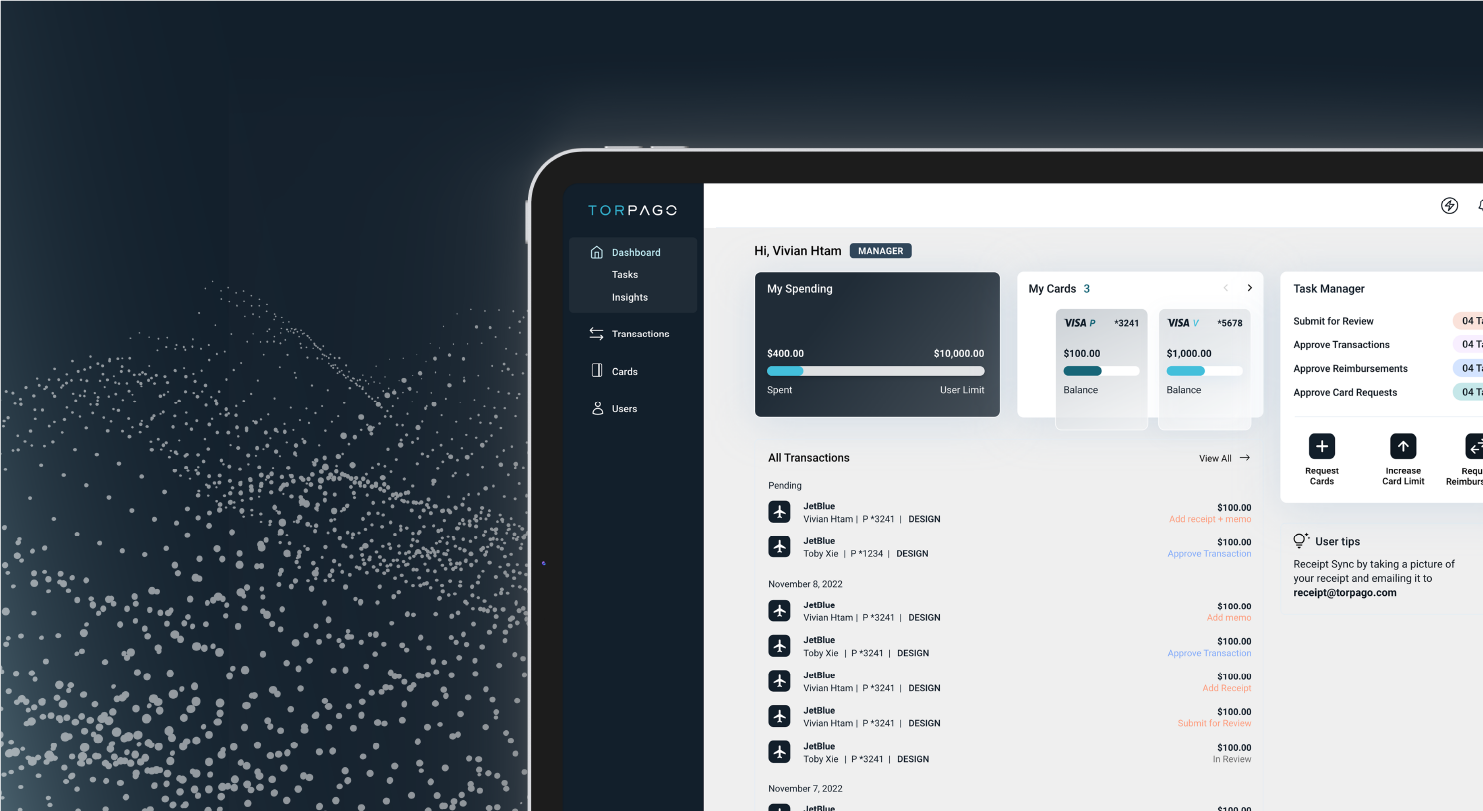

Torpago represents a faster, simpler, and more secure solution that fosters accountability and transparency.

The business reimbursement model is dying and Torpago is leading the way with modern tools for business. Torpago’s flexible spending management platform empowers companies with easy-to-use solutions that provide greater visibility into company spending.

Learn more about why businesses are increasingly eliminating expense reimbursement programs and adopting modern, flexible spending management platforms. Download our eBook, The Business Reimbursement Model Is Dying Making the Transition from Expensive Reimbursement.